EARL WATT

• Leader & Times

Residents received their required Revenue Neutral Rate letters this past week, and some experienced sticker shock.

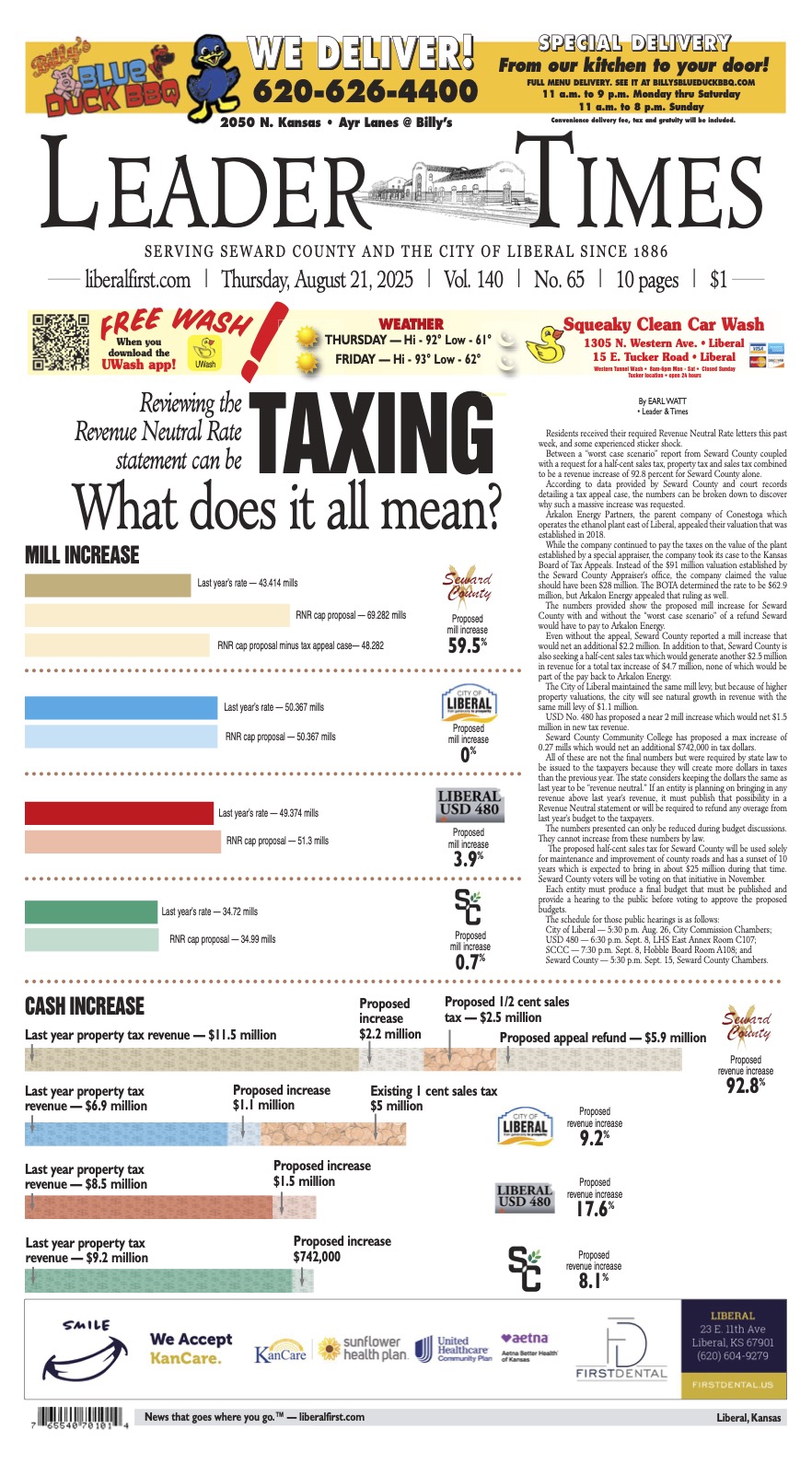

Between a “worst case scenario” report from Seward County coupled with a request for a half-cent sales tax, property tax and sales tax combined to be a revenue increase of 92.8 percent for Seward County alone.

According to data provided by Seward County and court records detailing a tax appeal case, the numbers can be broken down to discover why such a massive increase was requested.

Arkalon Energy Partners, the parent company of Conestoga which operates the ethanol plant east of Liberal, appealed their valuation that was established in 2018.

While the company continued to pay the taxes on the value of the plant established by a special appraiser, the company took its case to the Kansas Board of Tax Appeals. Instead of the $91 million valuation established by the Seward County Appraiser’s office, the company claimed the value should have been $28 million. The BOTA determined the rate to be $62.9 million, but Arkalon Energy appealed that ruling as well.

The numbers provided show the proposed mill increase for Seward County with and without the “worst case scenario” of a refund Seward would have to pay to Arkalon Energy.

Even without the appeal, Seward County reported a mill increase that would net an additional $2.2 million. In addition to that, Seward County is also seeking a half-cent sales tax which would generate another $2.5 million in revenue for a total tax increase of $4.7 million, none of which would be part of the pay back to Arkalon Energy.

The City of Liberal maintained the same mill levy, but because of higher property valuations, the city will see natural growth in revenue with the same mill levy of $1.1 million.

USD No. 480 has proposed a near 2 mill increase which would net $1.5 million in new tax revenue.

Seward County Community College has proposed a max increase of 0.27 mills which would net an additional $742,000 in tax dollars.

All of these are not the final numbers but were required by state law to be issued to the taxpayers because they will create more dollars in taxes than the previous year. The state considers keeping the dollars the same as last year to be “revenue neutral.” If an entity is planning on bringing in any revenue above last year’s revenue, it must publish that possibility in a Revenue Neutral statement or will be required to refund any overage from last year’s budget to the taxpayers.

The numbers presented can only be reduced during budget discussions. They cannot increase from these numbers by law.

The proposed half-cent sales tax for Seward County will be used solely for maintenance and improvement of county roads and has a sunset of 10 years which is expected to bring in about $25 million during that time. Seward County voters will be voting on that initiative in November.

Each entity must produce a final budget that must be published and provide a hearing to the public before voting to approve the proposed budgets.

The schedule for those public hearings is as follows:

City of Liberal — 5:30 p.m. Aug. 26, City Commission Chambers;

USD 480 — 6:30 p.m. Sept. 8, LHS East Annex Room C107;

SCCC — 7:30 p.m. Sept. 8, Hobble Board Room A108; and

Seward County — 5:30 p.m. Sept. 15, Seward County Chambers.