ROBERT PIERCE

• Leader & Times

With Seward County possibly facing a rise in its mill levy by nearly 26 mills due to an ongoing case with the Board of Tax Appeals, Administrator April Warden took the time to educate constituents about how appraisals work at the county’s most recent town hall meeting in Liberal.

“The county appraiser is responsible for determining the appropriate value of property based on state guidelines,” she said. “There are guidelines she uses to be able to appraise your property.”

Warden said real property is appraised at fair market value as it exists on Jan. 1 of each year, with the exception of land devoted as agricultural use, which is appraised at its used value, not its market value.

“Valuation notices are mailed out once a year by your county appraiser,” she said. “The valuation notice is the official notification of the county appraiser’s estimate of value for your real property. We have appraised valuation, and we have assessed valuation.”

Warden emphasized assessed is the actual value on which taxes are paid.

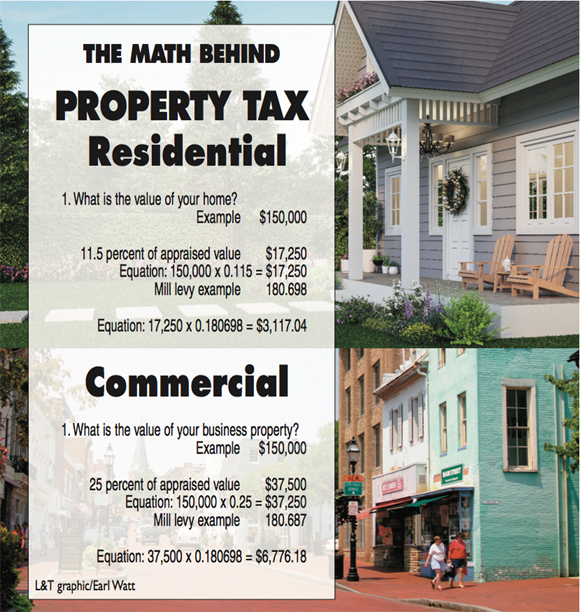

“For residential property, it is assessed at 11.5 percent,” she said. “Industrial and commercial property is assessed at 25 percent, and agricultural property is assessed at 30 percent of the projected value. Your assessed valuation equals the property’s appraised value times the assessment rate.”

Warden then addressed the mill levy rate, which she said is the amount of tax payable per dollar of assessed value of property.

“A mill is one-thousandth of a dollar,” she said. “In property terms, that equals $1 per $1,000 of assessed valuation, or one-tenth of 1 percent.”

Warden added the mill levy tax rate is applied to each of the county’s taxing jurisdictions to raise revenues and cover those budgets to pay for public services.

“That includes city, county, school districts, the fire district, the college, the state,” she said. “The mill levy rate of each jurisdiction is multiplied by your home’s assessed value or your business’s assessed value to give you an estimated tax bill. Total assessed valuation divided by 1,000 equals the value of one mill.”