EARL WATT

• Leader & Times

After proposing a 29 mill increase to Seward County taxes, the Seward County Commission during a recent budget discussion has now floated a balloon of a 13-mill increase after receiving information about the tax protest case between Seward County and Arkalon Ethanol.

A recent decision by the district court handling the case said that any decision would only be reflected on the three years under consideration by the court, and the county revised its “worst case scenario” estimate down since fewer years would be affected by any ruling by the court.

But the 13-mill suggestion would still result in a $3.6 million tax increase on all Seward County residents, which also includes residents in the cities of Kismet and Liberal.

During a town hall meeting, Seward County Chair Scott Carr responded to a member of the public who questioned the tax hike by saying the increase was due to inflation.

“Everything costs more,” Scott said.

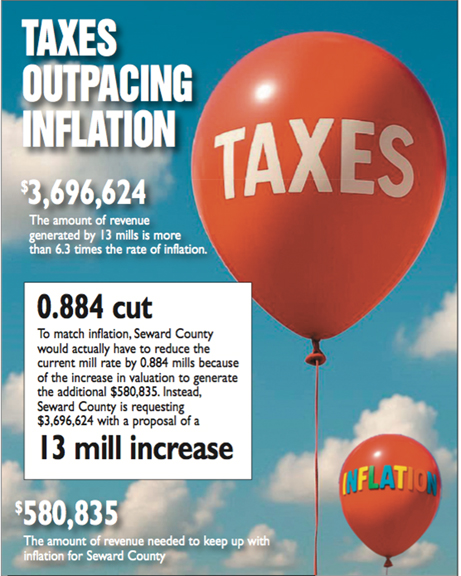

Comparing the rate of inflation to the Seward County budget indicates that while inflation may be a factor, it cannot be the only factor.

In 2024, Seward County brought in $11,513,562 in property tax revenue.

According to the inflation calculator at calculator.net, the rate of inflation from January of 2024 to August 2025, that number would equal $12,094,397.

That would mean an increase of $580,835.

But 13 mills would generate $3,696,624 instead, making the increase more than six times the rate of inflation.

Seward County will have a public meeting prior to approving the tax increase at 5:30 p.m. Monday in the commission chambers.