L&T staff report

After the massive tax increase passed the Seward County Commission by a 3-2 vote, several taxpayers have asked that the commission reconsider the budget.

Comments have been made that the commission cannot change the amount of taxes collected, but that statement is inaccurate according to Kansas Special Committee Chair Sen. Caryn Tyson.

Three Seward County residents provided testimony to the committee Monday including Seward County Appraiser Angela Eichman, L&T Publisher Earl Watt and Billy’s Ayr Lanes owner and Seward County Community College Board of Trustee Kelly Hill, among others in Kansas.

During Watt’s testimony to the committee, he shared how reluctance to revisit the recent 13 mill tax hike was attributed to not being able to change the budget.

“By statute they can amend their budget,” Tyson said. “They absolutely can amend it. So if they are saying they cannot, I’m not sure what that restriction would be, because it wouldn’t be statute.”

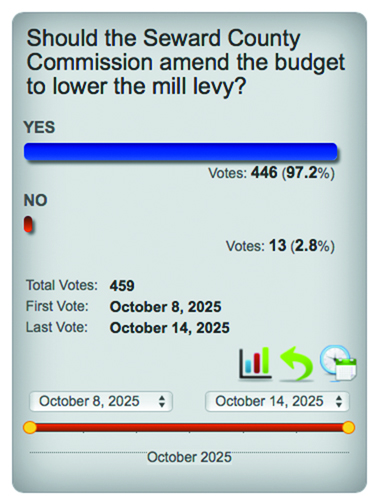

The Leader & Times posted an unscientific online poll, and the results were overwhelming in favor of the Seward County Commission revising the budget to reduce the mill levy.

Two complaints have been filed with the Kansas Board of Tax Appeals, but testimony provided by other taxpayers across Kansas have shown a decision could be years away.

One taxpayer shared how he built a $50,000 building, and it was taxed at $15,000 per year in another county. He has waited three years for a ruling.

Hill shared how his family bought the bowling alley, made necessary repairs, added a restaurant, and the property taxes skyrocketed from the previous rate.

The Kansas Legislature is collecting testimony from taxpayers and taxing entities to consider legislative corrections to address how property is assessed value as well as how taxing entities levy local taxes and if that ability should be limited.

One suggestion made by Rep. Marty Long was whether or not abated properties should still be assessed a value during the abatement period so that valuation concerns could be addressed earlier. He asked Eichman that question, and he said she believed that could be helpful.

Watt shared during his testimony that most of the recent massive increase was not being allocated to the valuation issue and provided the local county commission a reason for a general fund increase.