EARL WATT

• Leader & Times

During recent public meetings, Seward County leaders – including Chair Scott Carr – have claimed the reason for the recent 13.4 mill rate increase was inflation.

However, local school districts and the City of Liberal have not made any significant changes to their budgets.

Comparing the City of Liberal and Seward County would not be a fair comparison because the City of Liberal only taxes property within the city limits and Seward County taxes all property in the county. The same with USD No. 480 or USD No. 483 since they do not encompass the entire county.

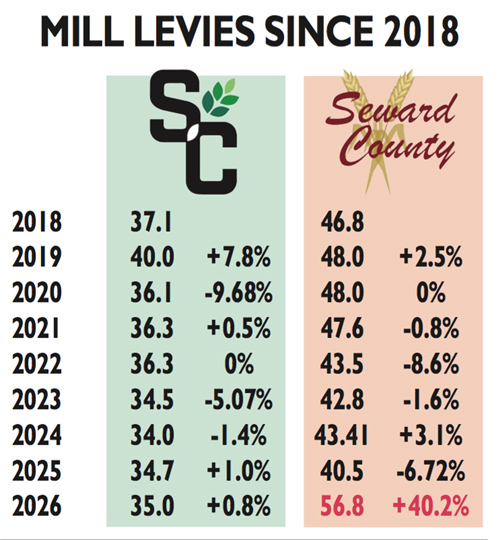

But Seward County Community College has the exact same taxing property as Seward County. Both tax all property in Seward County. Comparing those rates over time have shown a very similar tax pattern, until this year.

This chart shows how the college and the county were in alignment with very close comparisons until the proposed 2026 tax increase of 13.4 mills by Seward County in the exact same geographical area as SCCC.

It would be fair to believe inflation would have an equal impact on both agencies.

Also, Seward County funded a refund to National Helium from 2018 to 2021 and was still able to maintain a stable mill levy.