Kansas Health Institute

TOPEKA – As Kansans are filling their grocery carts for their Thanksgiving meals, the cost of feeding guests around the table may be a consideration.

To address rising food costs, Kansas will complete on Jan. 1, 2025, the process of reducing the state sales tax on food and food ingredients to 0.0 percent.

In 2022, the Kansas Legislature enacted House Bill 2106, which started the gradual reduction of this tax from 6.5 percent (one of the highest in the nation), to 4.0 percent on Jan. 1, 2023, and then to 2.0 percent on Jan. 1. 2024.

In a new brief, “Kansas Food Sales Tax: Exploring Policy and Research,” the Kansas Health Institute looks at both how Kansas’ food sales tax compares to other states and the impacts of grocery sales tax on health.

“Generally, the health impacts of food sales tax are felt through its financial effect,” said Samiyah Para-Cremer Moore, KHI senior analyst. “Food taxes impact households’ purchasing power and behavior but also community health and nutrition. Taxes are just one factor in nutrition though. Policies, systems and environments also play a role.”

Key points from the brief include:

• Under legislation passed by the Kansas Legislature in 2022, the state sales tax on food and food ingredients was reduced to 2.0 percent on Jan. 1, 2024, and will be reduced to 0.0 percent on Jan. 1, 2025. Food and food ingredients are still subject to sales taxes imposed by Kansas cities and counties.

• Thirty-eight states do not currently tax food as of October 2024, using a variety of policy strategies. Two states have passed legislation that in the future will exempt food (Illinois) or reduce food sales tax to zero (Kansas).

• Recent research suggests grocery sales taxes are associated with higher food insecurity rates, changes in consumer purchasing behavior and poorer health outcomes linked to obesity and diabetes, particularly for low-income households. These relationships can offer insights into potential positive health outcomes of removing taxes on food.

• A food sales tax may increase annual grocery costs by a few hundred dollars, and that additional cost can increase the financial burden of individuals and families that are already struggling to pay for food, housing, utilities, transportation and medical costs.

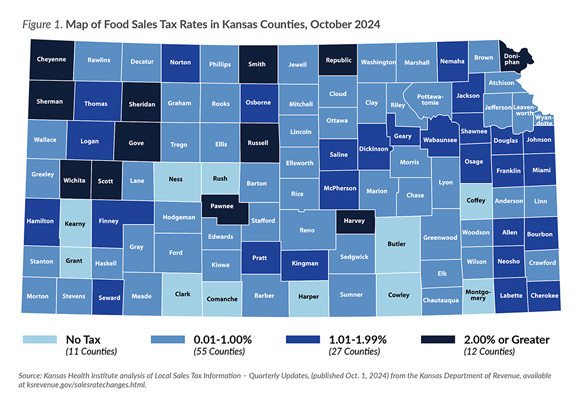

As noted in the key findings, although state sales tax of food and food ingredients will be at 0.0 percent in January 2025, city and county food sales tax rates may remain. The map below shows the local food taxing levels in October 2024.

Learn more about hunger in Kansas at Hunger Free Kansas. KHI developed the statewide report Hunger Free Kansas: Environmental Scan of Secondary Data to inform this initiative. KHI is a proud partner of Hunger Free Kansas.

For more information or an interview, please contact KHI Director of Strategic Communication and Engagement Theresa Freed at