ROBERT PIERCE

• Leader & Times

The recent proposed hike in Seward County’s mill levy for Fiscal Year 2026 has called into question many of the county’s practices.

With a difference in valuation of about $66 million between what the county appraised the Arkalon Ethanol plant at and what that company appraised the value, some of those practices come from the office of Appraiser Angela Eichman.

Eichman recently explained the appraisal process and some of what made up the difference between the appraised values from the county and Arkalon. She said there are three approaches to assessed value – the cost approach, the sales approach and the income approach – and she explained the use of each.

“The income approach is done on commercial property,” she said. “The cost approach is replacement cost new plus depreciation, and the sales approach is comparable sales. We have to stay within what the market is doing. With the sales approach, we get the sales after they’ve been sold, and we send those to the state once a month.”

With the sales approach too, Eichman said the county must be within 10 percent of a sales price, and that range could be either higher or lower than the sales price.

“If we’re not, we have to explain why our value is either high or low,” she said. “Maybe we’ve missed some information. Maybe they have finished out a basement, and we have it as unfinished. All the sales we get are after they’ve already been sold, not what they’re asking for them, but what they actually sold for.”

Eichman said the cost approach applies to replacement costs of structures.

“The income approach is market rents, which is more like your rental properties – mini-storages, motels, any offices that are not owner operated,” she said.

As far as the Arkalon appraisal is concerned, company officials claimed much of the equipment appraised was removable and therefore should not be appraised. Eichman explained why the equipment was appraised.

“There’s huge tanks that are used,” she said. “There’s transport pipes. All of that stuff is removable, but without it, it couldn’t operate. That is where the litigation is coming in.”

Eichman said while Kansas law does make commercial machinery and equipment exempt, the plant could not function without the removable equipment.

“The county’s view is it should be considered real estate because it could not operate without it,” she said. “Their view is if it’s removable, it should be exempt.”

Eichman said the methods the county and Arkalon used to appraise the plant led to similar overall values, and the difference came from what class of property the plant is considered.

“They’re trying to class it as personal property, which is exempt, and we’re trying to class it as real estate because it can’t operate without it,” she said. “That’s where the discrepancy is. The class of the property is what is at issue.”

As far as the appraisal process itself, Eichman said this starts with value notices being sent out by March 1, and she added instructions to file an appeal are on the back of the notices, with two options given.

“The first option is the informal appeal, which is when we send value notices,” she said. “They have 30 days from the date of mailing to contact our office to schedule a time to come in and go over their property, which is the appeal. We sit down, we go over the property, we check to make sure what we have listed is correct. If it’s not, we fix it. They explain their side and why they don’t feel the value is correct.”

Oddly, Eichman said some property owners do claim their value is too low.

“It’s not very often, but it does happen,” she said.

After meeting with property owners, Eichman makes a decision and notifies them by mail of that decision and whether the value stayed the same or changed.

“When they receive that decision, if they’re still not satisfied with the value, there are directions on it to show how to appeal it to the next level,” she said.

Eichman said a second option allows a property owner to file a payment under protest.

“That is when they have missed the time for an informal hearing,” she said. “Their only other option is to do a hearing when the taxes are paid. In order to do a payment under protest, you have to pay half of your taxes and file the protest at the same time.”

Eichman said, though, delinquent taxes must be paid in full in order to file a protest.

“At that time, we sit down, and we do the same thing,” she said. “It’s just a different process. The reason why it’s like that is all of the value our office sets, whether it’s oil and gas, personal property or real estate, we have to certify that entire file for the whole county to the state.”

At the time this is done, Eichman said the appraiser’s valuation process is done for the year.

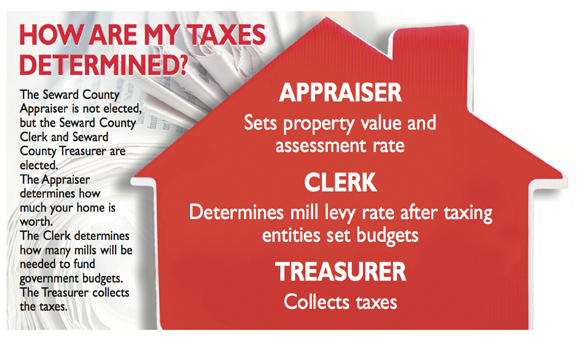

“The next part of that is when individual departments of the entities that get tax dollars put together their budgets for their individual budget hearings,” she said.

Eichman said this is done before levies go out.

“That’s why our values have to be done before the first step in that process,” she said. “With payment under protest, it’s after the fact, and the best time to have it is in the spring time because the value we certify is what we rely on to set the levy.”

With the value plus the budget equating to the mill levy, Eichman said what each entity receives depends on their own individual levy.

“If our value is higher and they don’t need any changes in the budget, the levy can be lowered or vice versa,” she said. “Because it takes all of those things to come up with a tax bill, it basically goes back to the budget. If my values are higher, they divide that into the budget, and that’s where the levy comes from. If the budget is high and our values are low, they’re going to need more mills, but we can also have a higher value and a high budget.”

Eichman emphasized this concerns the county’s overall budget.

“The mills can be higher,” she said. “We can have a high value and a low mill, and your taxes could still be higher or vice versa. It takes everything together. Everyone wants an overall high value for the county because it makes it easier for properties. It’s growth if things are moving.”

Eichman said there have been times when values have come down, and the sales approach is based on what the housing market has done.

“If they don’t pay as much for a property and overall, they start coming down, that’s going to be reflected in the comparable sales we use, but everything we use is stuff that’s already been done,” she said.

Eichman said land appraisals typically do not change from year to year once a value has been set.

“Those are based off land sales,” she said. “Once land sells and they build upon it, there’s not much comparison unless there’s other land sales that have sold. There’s no cost approach because there’s nothing being built. The land doesn’t typically go up, and when it does, it’s several years in between.”

Eichman said agricultural land is not valued locally.

“We are told by the State of Kansas what the values are going to be every year,” she said. “What we do for ag land, we have to make sure it’s being listed correctly – dry land, irrigated or grass. Each of those have different values based upon what the spreadsheet is they send us.”

The mill levy for FY 2206 was adopted earlier this year at more than 13 mills above the Revenue Neutral Rate, the rate at which the county would collect the same amount of revenue as the previous year. As to how much property owners will be affected, Eichman said this will depend on what the value of their property is.

“If their value decreased from last year to this year, if the levy goes up, they could still pay more in taxes,” she said. “If their value increased and the levy increased, they’re going to pay more in taxes. It depends on the amount of change in your value versus the change in the levy.”

Eichman said if property values are unchanged, but the levy increases, taxes will likely increase as well.

“You would have to have a pretty significant drop in value to offset the levy increase in order for your taxes to remain near or lower than what you paid the prior year,” she said.

Eichman said many people do not understand valuations are set using the county’s own guidelines.

“Values are set before the budget and the mill,” she said. “It’s not like we know if they’re going to increase the budget or not. Our stuff is done first, and we’re finished with that before they even look at the budget. What we do is we set values. We have our own guidelines that are provided.”

Eichman said the county’s appraisals are constantly monitored by the Kansas Department of Revenue’s Property Valuation Division.

“If we are not staying with what the market is doing, that means we are not in compliance with the guidelines,” she said. “We have our own set of rules and regulations we have to follow that has nothing to do with the budget or the mills.”

Eichman said the appraisal process is the first in a series of process that ends with the valuation and budget leading to the mill levy for the next fiscal year.

“That comes after everything we do,” she said. “As long as your property is correct and we valued it correctly, there’s not much that can be done because the issue isn’t with the value. It’s with the levy. If we have something incorrect, we can look at the values if somebody wants to bring in an appraisal and wants us to look at it, we can certainly do that.”

Eichman said only a portion of a property’s value is taxed.

“Your overall value, even if we may change the value by $5,000, it’s not going to change the assessed value very much at all,” she said. “Each category is different, and even if we may reduce the value, unless it’s like when a house was torn down and we still have the value on it or a house is built, there’s typically not a huge change in taxes even though it may show a few thousand dollars in value.”