ROBERT PIERCE

• Leader & Times

During the 2024 play year open enrollment period that ended Jan. 16, a record 171,376 Kansans selected or were automatically re-enrolled in a health insurance plan through the federally facilitated health insurance marketplace.

That number marks an increase of 37.7 percent compared to last year’s record high enrollment, and this marks the third consecutive year of record high enrollment.

The Kansas Health Institute recently released an brief detailing some of the marketplace enrollment trends, and highlights from the brief in attention to the record growth include:

• Overall, the average monthly premium paid by Kansans selecting a plan during the 2024 plan year open enrollment was $111, a $28 decreased compared to 2023. Eight insurers combined offered 98 plans on the Kansas marketplace in 2024. All counties had at least two insurers offering coverage.

• About nine in 10, more precisely 93.3 percent of marketplace enrollees took advantage of the enhanced Advance Premium Tax Credits (APTC) to reduce the cost of their monthly premium payments in 2024.

KHI Senior Analyst and Strategy Team Leader Linda Sheppard said the recent trends in marketplace growth can be attributed to the passage of a 2021 bill by Congress increasing the amount of APTCs eligible individuals could get when enrolling.

“We started to see the growth really happening there, and that growth has continued over time as more and more people started to become aware of the fact that ,depending on your household income, there was a really great opportunity to get a very reasonable plan for a pretty low price,” she said.

Sheppard said in some cases, individuals paid little to no money for premiums for insurance policies, and she said over time, as more eligible people who qualified for generous tax credits based on their household income discovered they could go to the marketplace and get a policy.

“The other thing we certainly saw specifically for this year is the fact as the Centers for Medicare and Medicaid had started to allow states to disenroll people who were in Medicaid, who had been in the Medicaid program for a number of years,” she said.

Sheppard said in the midst of the COVID-19 pandemic, the federal government asked states to keep people on Medicaid and not give typical reviews for eligibility which may have determined a person should have taken off of Medicaid because of a change in income level.

“Last year, when the federal government allowed states to start doing those reviews of those individuals, a lot of those people were found ineligible for Medicaid, so they were looking for alternative coverage at that point because they lost their Medicaid coverage,” she said.

Sheppard too said many states including Kansas were being proactive about helping individuals in danger of losing Medicaid coverage find alternative coverage if they were eligible and could qualify.

“They were proactive about making sure those individuals knew they might want to consider the marketplace,” she said. “They’ll connect you with individuals who’d be happy to help you look at that process and work through it and see if that’s a potential new coverage source for you, and I think a lot of people took advantage of that.”

In recent years, a piece of law in place since the beginning of the Affordable Care Act that made impossible for families to get coverage on the marketplace if one family member had insurance through their employer that was deemed affordable was removed.

“If you’re the individual in your family, the adult in your family who has insurance through your employer and it’s deemed affordable according to some rules the Affordable Care Act set up, originally under the law, that meant you were not eligible to go to the Marketplace and get advanced premium tax credits to help you pay for insurance,” Sheppard said. “The insurance might’ve been affordable for you, the employee, but if you were interested in adding your family members and dependents, that potentially would be very unaffordable.”

Sheppard said many companies would not cover such a large amount for families, so family members under the ACA law were not eligible to go to the marketplace until recently.

“Dad and Mom may have been able to get their affordable insurance, but if the rest of the family needed coverage, they either had to pay full price for it or just do without,” she said. “That family glitch, which it’s been referred to for a number of years, was adjusted and changed this year, so that no longer applies.”

With that portion of the ACA now removed, family members can get plans through employers and still leave other family members eligible for marketplace enrollment. Sheppard said household incomes can also be reviewed to see if families qualify for APTC to help pay for premiums.

“That was a nice change for those people who maybe had just been priced out of the marketplace because they were not going to be eligible for the premium tax credits,” she said.

As for what KHI projects for the coming enrollment year, Sheppard said this is not typically something agency officials do. She did say, though, enrollment would potentially continue to grow due to increased awareness of the availability of quality plans for reasonable prices.

“We’ve seen it over the past three years continue to rise every year,” she said. “I would be surprised if it didn’t go up, but it has certainly surprised in terms of the amount it has gone up each year.”

With a total state population of nearly 2.9 million, Sheppard said 171,000 Kansans may seem small, but she said the majority of those insured in the Sunflower State do so through their employer.

“That’s been the way it’s typically been done for decades,” she said. “Most people get their coverage that way. You have this number of individuals in the state who, for whatever reason, are not able to get coverage through their employer. Their employer doesn’t offer it, or it’s too expensive.”

Sheppard said this number represents individuals who are likely to be able to go to the marketplace and potentially have the ability to get coverage there.

“That is what I would refer to as the individual insurance market as opposed to the employer insurance market,” she said. “That number has always been relatively small because there are fewer people for whom that’s the only alternative because they don’t get it through their employer.”

Sheppard said the numbers KHI report are collected from the U.S. Census Bureau.

“That’s where we get our data,” she said. “We get this data from the Centers for Medicare and Medicaid (CMS) every year after the open enrollment period, and they provide all of this data to us.”

Sheppard said this information is publicly available, but each state likewise gets specific numbers for their own state.

“All of the data we provide that came this month came from CMS,” she said. “We also look at Census data and other things, but most of that data in terms of the specifics about how many people enrolled and what kind of plan they purchased comes from CMS.”

The most recent enrollment period saw eight insurers offering a total of 98 plans in Kansas. The first year of open enrollment was 2013, and that year had many insurers in the marketplace offering coverage.

Sheppard said in the past decade, that number has dropped significantly because many insurers questioned whether they wanted to continue to offer coverage, but she said a return to growth is starting to be seen. She did say, however, she believes eight insurers is a good number.

“There are a number of different kinds of companies, and there is coverage across the entire state,” she said. “If you’re somebody who wants to use marketplace coverage, you’re likely to find a plan and a number of plan options that are available to you. I think it’s a good number of plans that are out there that are available from those eight insurers.”

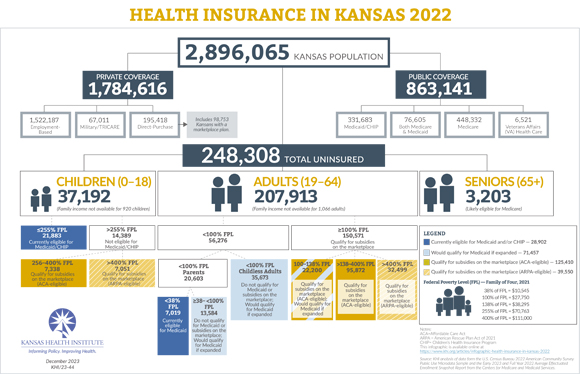

Of the Kansas population, in 2022, nearly 1.8 million had private insurance coverage, and Sheppard said 1.5 million of those people had employment-based insurance.

Medicaid expansion has been a hot topic in the past year in Kansas, and Sheppard said as of the close of the most recent legislative session in Topeka, expansion has not happened.

“We are now one of nine states who still have not expanded Medicaid in the country,” she said. “The legislative session that just ended in May of this year, there were two bills that were introduced by Governor Kelly for Medicaid expansion. One of those bills did get a type of hearing, but nothing happened. There were no votes on that bill. Bills have been introduced consistently for years in Kansas to expand Medicaid, and the legislature so far has not approved that.”