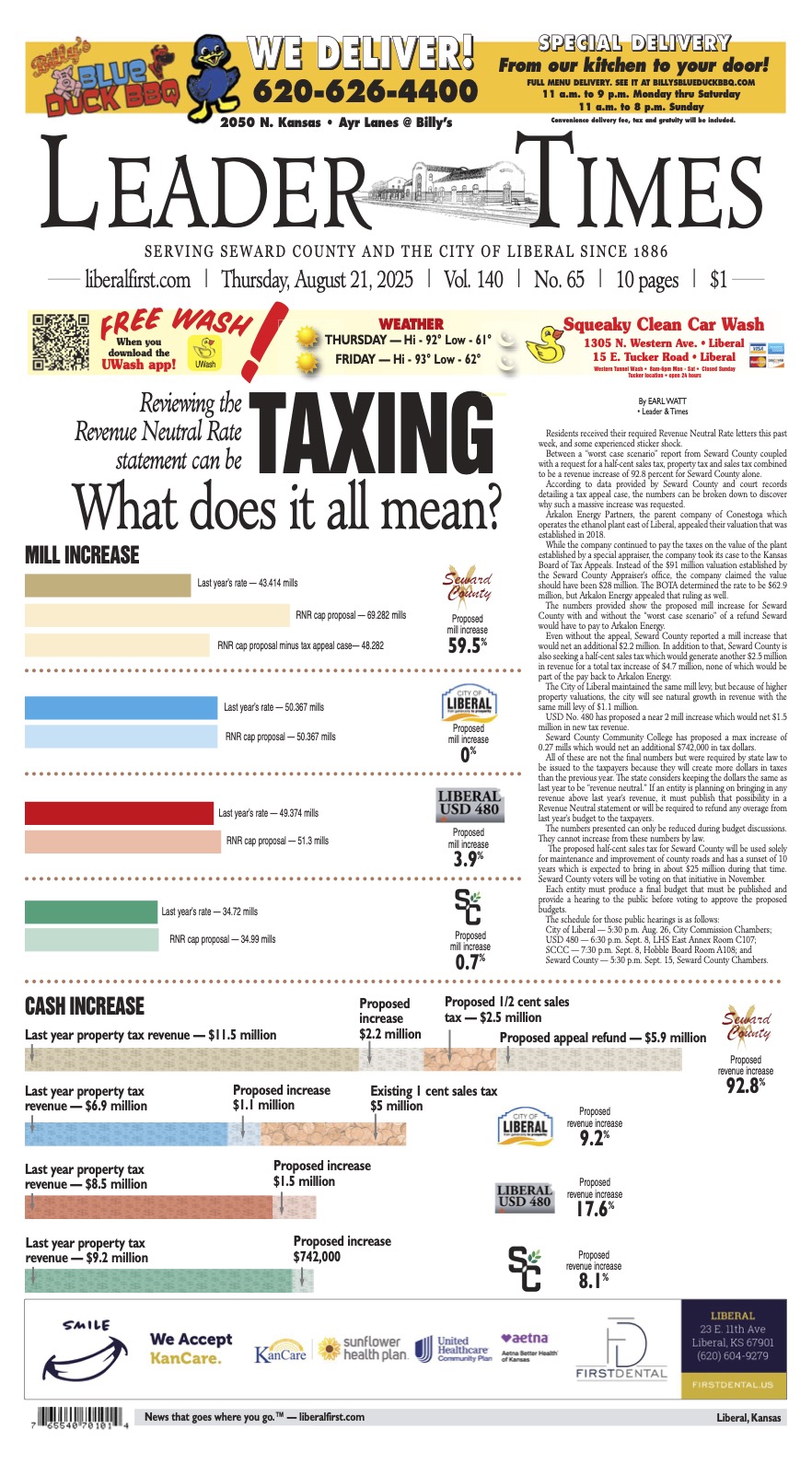

Reviewing the Revenue Neutral Rate statement can be TAXING – What does it all mean?

EARL WATT

• Leader & Times

Residents received their required Revenue Neutral Rate letters this past week, and some experienced sticker shock.

Between a “worst case scenario” report from Seward County coupled with a request for a half-cent sales tax, property tax and sales tax combined to be a revenue increase of 92.8 percent for Seward County alone.